ECN vs STP Brokers: What’s the Difference?

In the world of forex trading, the type of broker you choose can significantly affect your trading experience. Two of the most popular types of brokers are ECN (Electronic Communication Network) and STP (Straight Through Processing). While they may seem similar on the surface, they differ in structure, pricing, execution speed, and how they handle your trades.

This article will explain the differences between ECN and STP brokers, help you determine which type suits your trading style, and introduce some of the top ECN and STP brokers available in 2025.

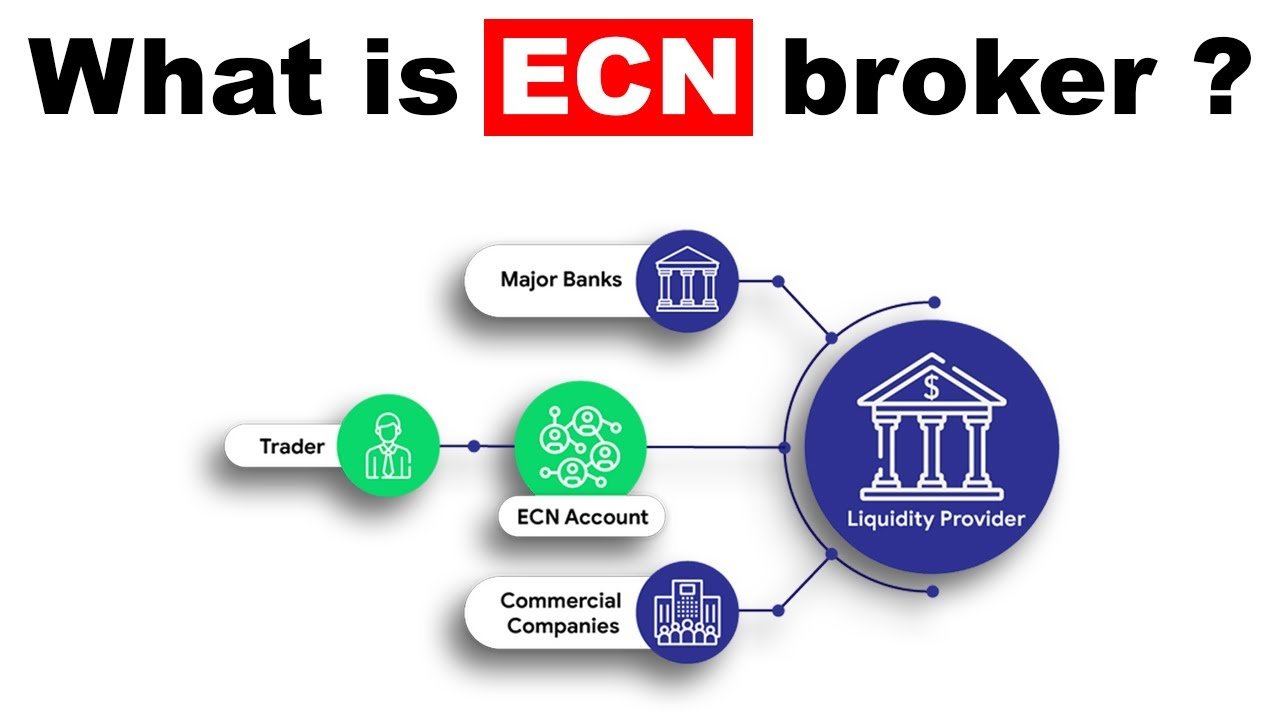

Understanding ECN Brokers

ECN brokers operate as a digital hub, connecting traders directly with other participants in the forex market, including banks, hedge funds, and other retail traders. Instead of acting as a market maker, an ECN broker matches your trade with another participant in real time.

Key Features of ECN Brokers

- Direct Market Access: Your trades are sent straight to the market, with no intermediary involved.

- Tighter Spreads: ECN brokers often offer raw spreads as low as 0.0 pips, but charge a fixed commission per trade.

- No Dealing Desk: Orders are executed without broker intervention, minimizing conflict of interest.

- Level II Pricing: Some ECN brokers offer visibility into the order book, showing real-time bid/ask depth.

Pros of ECN Brokers

- Transparent pricing

- Faster execution, ideal for scalpers

- Less risk of requotes

- Better for high-volume traders

Cons of ECN Brokers

- Commission fees on top of spreads

- Requires higher minimum deposits with some brokers

- May be less beginner-friendly

Understanding STP Brokers

STP brokers also send your orders directly to liquidity providers, but the process differs slightly. Instead of matching trades on an open network, they route orders to one or more liquidity providers (banks or institutions) who then fill the order.

Key Features of STP Brokers

- Multiple Liquidity Providers: Orders are routed through a pool of external providers who offer the best price.

- No Commissions in Many Cases: STP brokers often build fees into the spread rather than charging a separate commission.

- No Dealing Desk: Like ECN brokers, STP brokers do not interfere with trades.

Pros of STP Brokers

- Simple fee structure (usually no commissions)

- Faster than traditional market makers

- Suitable for beginner to intermediate traders

- Lower deposit requirements

Cons of STP Brokers

- Spreads may be wider than ECN

- Less transparency in pricing

- Some risk of slippage during volatile markets

ECN vs STP: A Side-by-Side Comparison

| Feature | ECN Broker | STP Broker |

|---|---|---|

| Order Execution | Direct match with market participants | Routed to external liquidity providers |

| Pricing Model | Raw spreads + commission | Marked-up spreads, usually no commission |

| Spread Type | Very tight, often 0.0 pips | Variable, generally wider |

| Speed of Execution | Very fast | Fast, but depends on liquidity |

| Ideal For | Scalpers, high-frequency traders | Beginners, swing traders |

| Transparency | High | Moderate |

Top ECN Brokers in 2025

1. IC Markets

IC Markets is one of the most popular ECN brokers worldwide. Known for its ultra-tight spreads and fast execution, it caters to both retail and professional traders.

- Minimum Deposit: $200

- Commission: $3.50 per lot per side

- Platforms: MetaTrader 4, MetaTrader 5, cTrader

- Regulation: ASIC, CySEC, FSA

2. Pepperstone

Pepperstone offers both ECN-style (Razor account) and STP-style (Standard account) trading. The Razor account is popular among scalpers and algo traders.

- Minimum Deposit: $200

- Commission: $3.50 per lot per side (Razor)

- Platforms: MT4, MT5, cTrader

- Regulation: FCA, ASIC, BaFin

3. FXTM (ForexTime)

FXTM’s ECN accounts offer fast execution and raw spreads, making it a suitable choice for experienced traders.

- Minimum Deposit: $500

- Commission: Varies by account

- Platforms: MT4, MT5

- Regulation: FCA, CySEC, FSCA

Top STP Brokers in 2025

1. XM

XM is a highly trusted STP broker with low minimum deposit requirements and great educational tools for beginners.

- Minimum Deposit: $5

- Commission: None

- Platforms: MT4, MT5

- Regulation: ASIC, CySEC, IFSC

2. FxPro

FxPro is a multi-asset broker offering both STP and ECN execution depending on account type. Their cTrader platform offers transparent pricing.

- Minimum Deposit: $100

- Commission: Included in spread (MT4/MT5), or per trade (cTrader)

- Platforms: MT4, MT5, cTrader

- Regulation: FCA, CySEC, FSCA

3. FBS

FBS offers user-friendly STP accounts and is particularly strong in Southeast Asia and Latin America.

- Minimum Deposit: $1 (cent account)

- Commission: None on standard accounts

- Platforms: MT4, MT5

- Regulation: CySEC, IFSC

Which Broker Type Is Right for You?

The right choice depends on your trading style and experience level.

- Choose an ECN broker if:

- You’re a scalper or high-volume trader

- You want raw spreads and can handle commissions

- You care about speed and transparency

- Choose an STP broker if:

- You’re new to trading

- You prefer a simpler fee model

- You plan to trade less frequently or with smaller volumes

Many brokers now offer both ECN and STP accounts, allowing you to try both and see which suits your style better.

Final Thoughts

Understanding the difference between ECN and STP brokers is crucial for making the most of your trading experience. ECN brokers provide tighter spreads and faster execution at the cost of commissions, while STP brokers offer simplicity and accessibility with slightly higher spreads.

As a trader, aligning your broker type with your goals and strategy can improve your results, reduce costs, and increase overall satisfaction. Whether you’re just starting out or looking to scale, choosing the right broker is a foundational decision that sets the tone for your entire trading journey.