Pros and Cons of CFD Trading for New Investors

Contracts for Difference (CFDs) are a popular financial instrument that allows investors to speculate on price movements without owning the underlying asset. From forex and commodities to stocks and indices, CFD trading offers flexibility, leverage, and access to global markets. However, for new investors, it’s essential to understand both the benefits and risks before getting started.

This guide explores the key advantages and disadvantages of CFD trading for beginners, helping you decide if it’s the right path for your investing journey.

What Is CFD Trading?

CFD trading is a form of derivative trading where you enter into a contract with a broker to exchange the difference in price of an asset between the opening and closing of a trade. Unlike traditional investing, you do not own the actual asset. Instead, you’re speculating on whether the price will rise or fall.

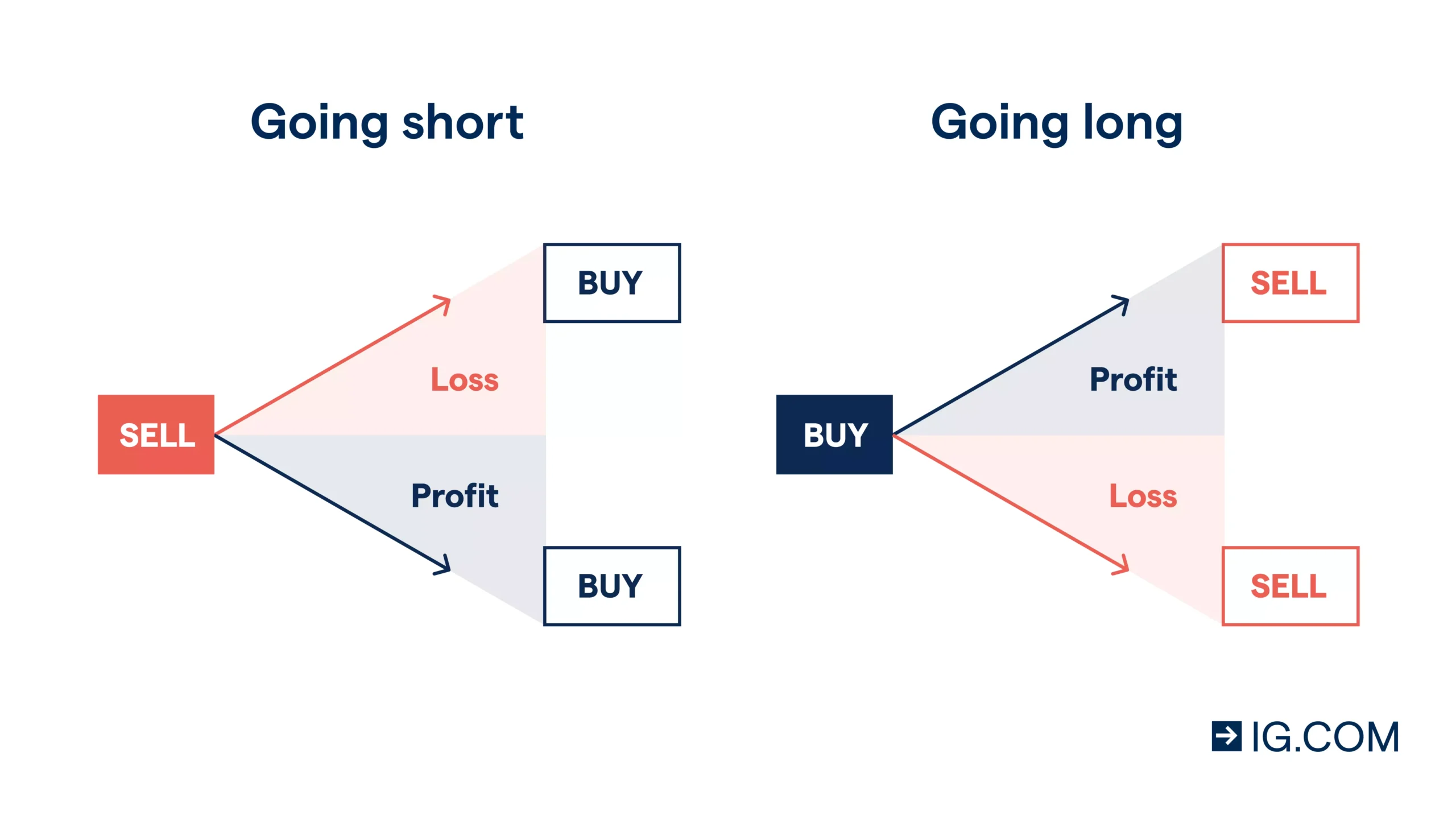

This approach allows for both long (buy) and short (sell) positions and often involves the use of leverage. While this opens the door to higher returns, it also significantly increases risk.

Let’s break down the pros and cons of CFD trading from a beginner’s perspective.

Pros of CFD Trading

1. Access to Global Markets

One of the biggest advantages of CFD trading is the ability to trade a wide variety of markets from a single platform. Most CFD brokers offer access to:

- Forex (currencies)

- Commodities (gold, oil, natural gas)

- Indices (S&P 500, FTSE 100)

- Shares of global companies

- Cryptocurrencies (Bitcoin, Ethereum, etc.)

This variety allows investors to diversify their trading strategy and seize opportunities in multiple sectors without needing separate accounts or trading platforms.

2. Leverage

CFDs are traded on margin, meaning you can open a position by only depositing a fraction of the total trade value. For example, a broker might offer 10:1 leverage, allowing you to control a $10,000 position with just $1,000.

For new investors with limited capital, this makes it possible to participate in larger trades and potentially earn higher returns. However, leverage also magnifies losses, which we’ll discuss in the cons section.

3. Ability to Trade Both Rising and Falling Markets

Unlike traditional investing, where profits are made from buying low and selling high, CFD trading allows you to also profit from price declines. By opening a short position, you can benefit if the asset drops in value.

This flexibility makes CFDs particularly useful during market downturns or economic uncertainty.

4. No Stamp Duty or Asset Ownership Requirements

Since you don’t own the underlying asset in a CFD, there’s no need to pay for custody services or storage (e.g., physical gold). In some jurisdictions like the UK, CFD trading is also exempt from stamp duty, which can lead to cost savings over time.

5. Real-Time Execution and Advanced Platforms

CFD brokers often provide advanced trading platforms such as MetaTrader 4, MetaTrader 5, or proprietary platforms with tools like:

- Real-time charts

- Technical indicators

- News feeds

- Risk management settings

These tools allow beginners to learn technical analysis and practice risk control techniques with demo accounts before trading with real money.

Cons of CFD Trading

1. High Risk of Loss Due to Leverage

While leverage increases profit potential, it also increases the risk of significant losses. A small adverse move in the market can wipe out your entire margin. This is especially dangerous for beginners who may not fully understand how margin requirements and liquidation levels work.

For example, with 10:1 leverage, a 10% market movement against your position can result in a total loss of your capital.

2. Overtrading Temptation

The accessibility and low entry cost of CFD trading can tempt new investors to trade excessively. Overtrading not only increases transaction costs but also raises emotional stress, leading to impulsive decisions and inconsistent results.

Beginners often struggle with self-discipline, which is crucial for long-term success in CFD trading.

3. Fees and Spreads

CFD trading may involve spreads (the difference between the buy and sell price), overnight financing charges (swap or rollover fees), and inactivity fees. These costs can eat into profits, especially if trades are held for multiple days.

Understanding fee structures and comparing brokers is essential before opening an account.

4. No Ownership or Dividends

With CFDs, you don’t actually own the underlying asset. That means you miss out on certain benefits such as:

- Voting rights (for stocks)

- Receiving physical commodities

- Direct dividend payments (some brokers offer adjusted dividend payments for stock CFDs, but not all)

If you’re interested in long-term investing and value ownership, traditional investing may be a better fit.

5. Regulatory Differences and Broker Risk

Not all CFD brokers are created equal. Some operate under strict regulatory oversight (like FCA in the UK or ASIC in Australia), while others may be offshore or loosely regulated.

Unregulated brokers can pose a risk to your funds. As a beginner, it’s critical to choose a reputable broker with transparent policies, segregated client accounts, and clear withdrawal processes.

Is CFD Trading Good for Beginners?

CFD trading can be a useful tool for new investors who:

- Understand the risks and are willing to learn

- Want to trade in various markets using small capital

- Are interested in short- to medium-term speculation

However, it is not suitable for those looking for passive income, long-term wealth building, or who are risk-averse.

Many beginners start by using a demo account to gain experience without real financial exposure. This helps develop discipline and strategy before moving on to live trading.

Tips for New CFD Traders

- Start with a Demo Account

Practice your strategies using virtual funds until you’re comfortable. - Use Low Leverage

Start with the minimum leverage available to reduce risk exposure. - Educate Yourself Continuously

Follow news, take courses, and understand both technical and fundamental analysis. - Manage Risk Properly

Always set stop-loss levels and risk only a small portion of your capital per trade. - Avoid Emotional Trading

Stick to your trading plan and avoid reacting emotionally to short-term market movements.

Conclusion

CFD trading offers a flexible and exciting entry into the world of financial markets, especially for new investors looking to actively trade with limited capital. The ability to access global markets, go long or short, and use leverage are attractive features—but they come with significant risks.

Understanding the pros and cons of CFD trading is the first step in deciding whether this form of trading aligns with your investment goals and risk appetite. For beginners, education, discipline, and choosing the right broker are key to navigating the CFD market successfully.